Freefall

Welcome to another issue of Vault, my newsletter on the technology defining the new internet. This week, the subject is recent global market events and what they mean for digital assets. We’ll also look at the fundamental aspects that make a good web3/DeFi project. If you like this post, please hit the heart at the bottom of the page.

Freefall

This week was long. The markets remain in freefall with no bottom in sight. Financial asset prices are deflating across the board. P/E multiples are crushed. Large tech companies are laying off staff. Some VC funds are putting a freeze on new investments. A wave of high-profile insolvencies in the crypto space is causing lasting damage to the space. The crypto market structure is changing. These crashes begin when something sparks fear. That fear begins to spread, and the spreading fear tips the scales. In this case, there were two causes.

First: crypto ran out of liquidity to absorb, followed by a run to the exit. After a sharp run-up led by Bitcoin reaching its all-time high of $69k in November last year, the market reached its blow-off top. There was no one left to buy. Prices fell by roughly 50% over the next six months. Wealth melted away as the market looked for buyers. Some bought at $45K expecting a new all-time high would be on the way. Bitcoin is down another 50% and then some since then. Sometimes the dip keeps dipping.

Second: the macro outlook and the shadow of a hawkish Fed. On Wednesday, the Fed raised interest rates by 75 bps, the largest rate hike since 1994. Rates are expected to reach 3.4% by the end of 2023.

The War in Ukraine also continues, putting pressure on global food and oil supplies. The West continues to supply Ukraine with advanced weaponry and maintains its sanctions against Russia. But there is growing evidence that the sanctions may not be as effective as we think, which leads to a fear of escalation. On the other hand, the head of Britain’s armed forces believes that Russia has already “strategically lost.”

Cracks in the global financial system are beginning to show as well. Japan’s bond market is under extreme pressure. As the largest holder of US Treasuries (UST), Japan may have to continue selling Treasuries due to the weakening Yen—Treasury sales which would likely have to be absorbed by the Fed. The Fed has $2 trillion in its Reverse Repurchase Agreement reserves for this purpose, but things get more desperate once those reserves run out. It’s a rock and a hard place kind of situation, and combined with everything else—it paints a dark financial picture.

Things are starting to break in strange places.

How Fear Spreads

At this point, market fears are spreading like a contagion. Lower prices cause more selling which lowers prices. It’s a vicious cycle that will continue until the market finds a bottom.

The interesting thing to watch is whether crypto or equities will find the market bottom first. If the view holds that crypto is a further out liquidity sponge (i.e., people invest in crypto with excess liquidity beyond their equity portfolios), then crypto would find the market bottom first, followed by equities.

The second thing to watch would be if crypto and equities still correlate as the market heads down or if they decouple at some point.

Taking Bitcoin (BTC) specifically, my view has always been that BTC’s price acts like a call option on a censorship-resistant network for information and money. The price may fluctuate wildly based on several factors, but fundamentally—Bitcoin is self-sovereign, non-government money backed by a robust, trustless network. If you buy it now, as it is still being adopted, it is difficult to say where the price will be within the next few years—much like a long-term call option. But the core technology works well, even in down markets.

That’s what is most revealing about this market downturn: Even when crypto hedge funds implode, projects become insolvent, and prices crash—the networks still work. Transactions are still processed. No central authority with overreaching powers can do Quantitative Easing or provide bailouts at the taxpayer’s expense. This is how free markets function. Market corrections will always be painful for those who lose money. But this is what crypto was always meant to solve.

Fundamentals

Over the long term, it’s unclear how crypto prices fare in a rising-rate environment with little to no money printing. Likely, prices will reset, and valuations will return to fundamentals. Companies and protocols with cash flows will survive, and those without—will not.

The projects that survive will do so by retaining loyal users and charging those users real, scarce money for their product or service. This produces steady cash flows. Offering inflationary tokens can work to a degree but is not sustainable over the long term. Most projects don’t need a token. Some will be able to use a project-owned token in novel ways, but most use it as a marketing tactic to draw in users.

Users will concentrate on the market-leading protocols, which will give those protocols massive moats to defend themselves against competitors.

Opensea

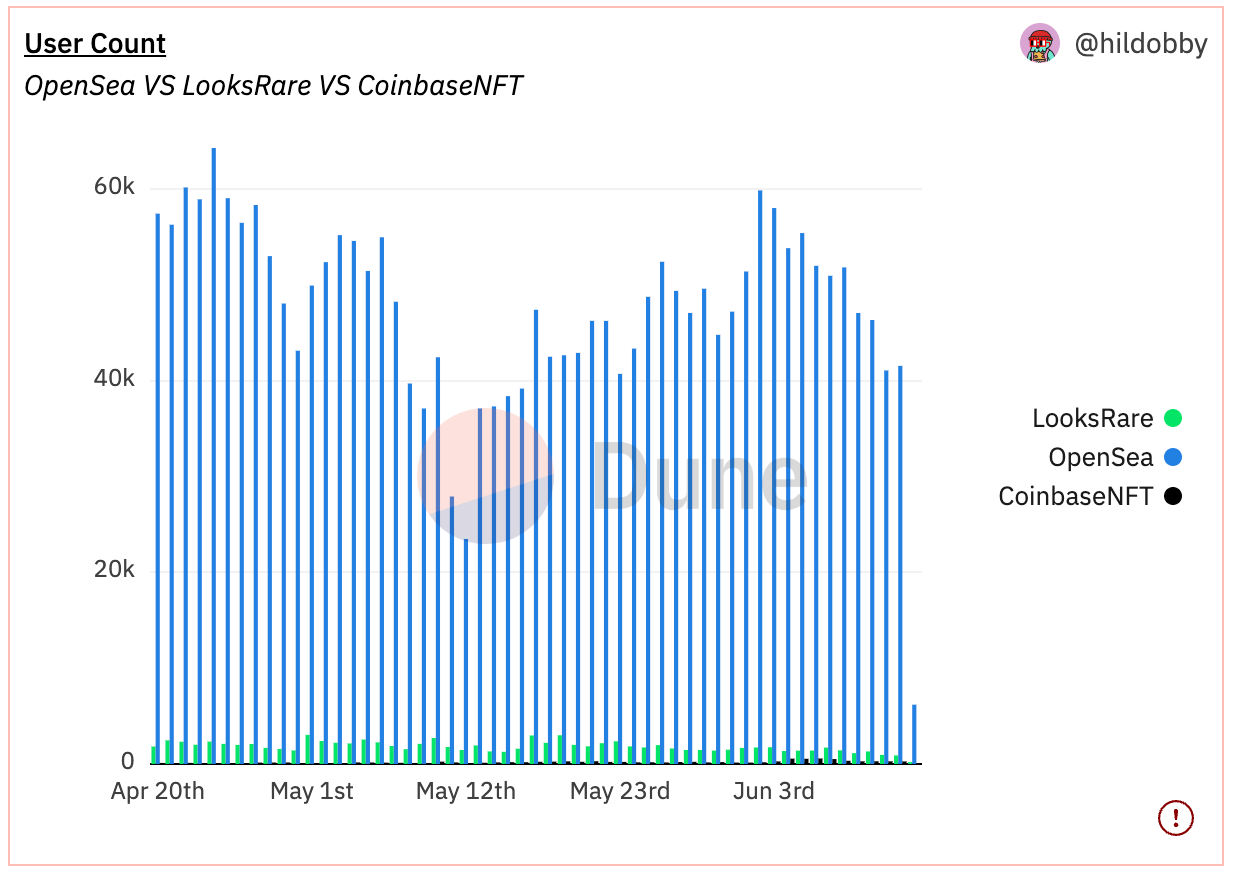

Looking at the NFT markets, the largest exchanges are OpenSea and LooksRare. It will be difficult for any new platform to unseat either of those two as the largest exchange. As anyone who has tried to sell an NFT knows, liquidity is essential and comes from users participating in the exchange. This effect is similar to that of social networks. It doesn’t matter how good the product is if no one is on the network. Getting the first users is beyond difficult—as we have seen with start-up social networks over the years. Market liquidity is the same. It doesn’t matter how good the exchange product is if there is no one buying or selling.

It will be near impossible for a new rival exchange to pull liquidity away from the top two exchanges. It’s not even clear if LooksRare will be able to maintain cash flows against OpenSea’s monopoly on the space.

The chart above tells a compelling story about how difficult it is to break into concentrated markets with network effects. If you look closely, you can see Coinbase NFT as the underbrush in the blue forest of Opensea.

Uniswap

The Decentralized Exchange (DEX) is the other DeFi primitive that was nearly perfected during the last cycle. A Decentralized Exchange provides the ability for users to create liquidity pools (LPs), and receive a portion of the trading fees from that pool. An Automated Market Maker (AMM), algorithmically sets the market clearing price, using current and historical data acquired across all the LPs on the exchange.

The proof that AMMs are the future of Decentralized Finance is being proven right now. DEXs continue to function and calculate the market clearing prices regardless of the state of the market at large. This is further proof that the concept works in a variety of market situations, and can withstand massive spikes in trading volume.

Uniswap is the market leader among DEXs by a wide margin.

Uniswap is in pink below. Curve is in dark green.

Uniswap gains a defensible position in a market downturn from the revenue it can capture via trading fees. Below are Uniswap’s 7-day fees across all trading pairs and the top 15 pairs. Uniswap currently brings in upwards of $1 billion in annual revenue. Even if trading volumes decline, causing a decline in trading fees—Uniswap will be able to maintain a strong balance sheet given its high margins.

Cash Flow is King

The commonality between these two companies is their cash flows via trading fees. They both charge users real money, and those users are happy to pay because the products are valuable. This is nothing new, and it is the way the space will need to grow as it matures.

The focus on real cash flows also lends itself to real valuations. Many of the valuations from the last cycle were based on theoretical Total Addressable Market (TAM) calculations, and hype-driven speculative bubbles. Solid crypto businesses with cash flows can be valued on more reliable Discounted Cash Flow (DCF) valuations—the same way that companies have been valued for a long time. In the short term, this is painful for companies and investors that will have to brace for collapsing valuations. But this is good in the long term. This will mean better opportunities for investors, and more realistic valuations for companies that can be defended in both up and down markets.

Things will likely get worse before they get better. We haven’t even started Quantitative Tightening yet. When that happens, things will uncomfortable for awhile. Maybe the Fed will be able to deleverage the economy without too much pain. But who knows? Do you trust the Fed to be able to deliver a soft landing?