Clean, Zero-Emission Bitcoin

The critique of Bitcoin mining often heard in the press and among politicians is that it is energy-intensive.

They tend not to go much deeper than that, and the public is left to assume that energy-intensive processes are bad. This (faulty) assumption is often based on the idea that all of our resources are finite (and always will be), and thus Bitcoin mining should be banned to preserve our finite resources.

On the energy-intensive point, Bitcoin mining does use large amounts of electricity—by design. The process that computers run to secure the Bitcoin network is called Proof-of-Work. The energy requirements to complete the calculations necessary to participate in the consensus protocol make it nearly impossible for a single entity to compromise the network.

Because we are not all starting from the same point of knowledge, and some of the terms surrounding Bitcoin can be confusing—it is good to state the following clearly so that we are all on the same page.

Bitcoin mining runs entirely on electricity as its energy source. Thus, the mining process is 100% clean and zero-emission at the point of operation.

But, of course, the total carbon footprint is calculated based on the production of that energy, which is where the entire debate lies.

The press attempts to sway the public against Bitcoin by pushing a narrative that aligns the mining process with high-carbon-footprint energy production.

The excerpt below is from AP News:

“An obstacle to large-scale bitcoin mining is finding enough cheap energy to run the huge, power-gobbling computer arrays that create and transact cryptocurrency. One mining operation in central New York came up with a novel solution that has alarmed environmentalists. It uses its own power plant.” [AP News]

The article refers to a natural gas plant in upstate New York called Greenidge. According to the article, the bitcoin mining process is “power-gobbling,” and environmentalists are “alarmed” (and you should be too, or so the narrative goes).

Also, from the AP piece:

“Bitcoin miners unlock bitcoins by solving complex, unique puzzles. As the value of Bitcoin goes up, the puzzles become increasingly more difficult, and it requires more computer power to solve them. Estimates on how much energy Bitcoin uses vary.” [AP News]

The second sentence is inaccurate. The Bitcoin network uses a network of computers that compete to group transactions into ‘blocks’ and broadcast those blocks to the network. The blocks are linked together with a SHA-256 hash of the previous block (hence ‘blockchain') and a ‘proof-of-work.’ This proof-of-work is called a ‘nonce’ (or number-used-once). The computer, or group of computers, that successfully create a block is rewarded with new bitcoin. Every four years or so, the reward for creating a block decreases by half as the total amount of bitcoin created gets closer to 21,000,000—the total amount of bitcoin that will ever exist. This is referred to as a ‘halving.’

So, with everything else constant, mining operations must rely on more advanced, efficient hardware or cheaper energy to maintain margins. The idea that the power consumption (and thus the cost of that power consumption) would increase indefinitely is wrong and undercuts the validity of the criticism entirely.

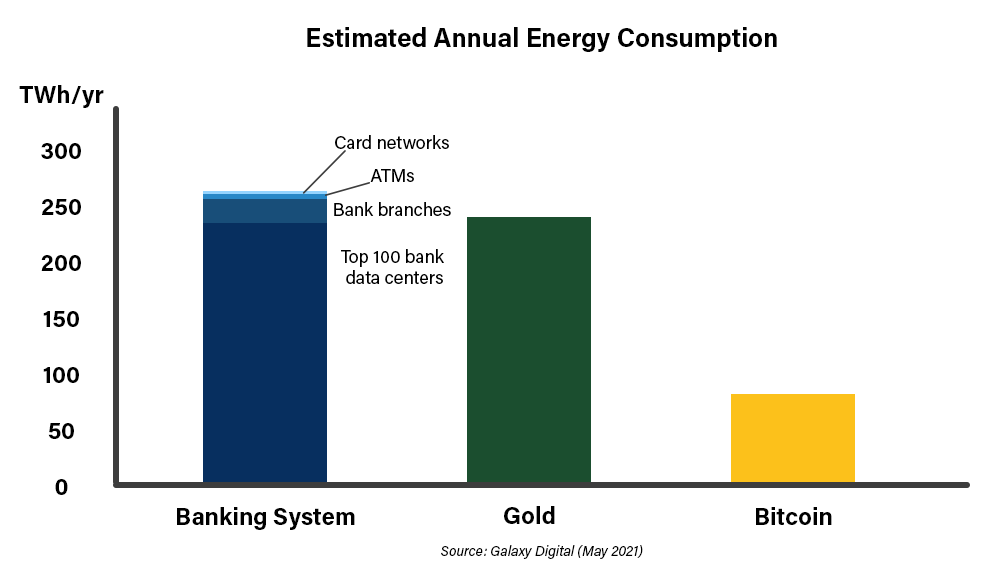

The last sentence of the excerpt is misleading by abstraction. One would think they would present some of those varying estimates. Here is one estimate:

Here is a more balanced, nuanced take from CoinDesk:

“Finally, there may be less reason to worry than the alarming headlines proclaim. Bitcoin’s miners are unlikely to increase at the same scale as they did a few years back. That is in part due to bitcoin halving, which is built into the Bitcoin blockchain and reduces the block rewards miners get every four years. So unless bitcoin’s value continues to rise to compensate for the drop, miners will need to shift toward more efficient equipment and cheaper sources of energy in order to maintain margins and keep large-scale mining operations viable.” [CoinDesk]

So what about those ‘alarmed’ environmentalists who opposed the Greenidge bitcoin mining operation?

They are The Sierra Club, Seneca Lake Guardian, and the Committee to Preserve the Finger Lakes. The groups brought a motion against Greenidge over its bitcoin mining operation. After hearing the petition in court, the judge ruled in favor of Greenidge and the motion was dismissed.

The full text of the decision by the Supreme Court of the State of New York, Judge Daniel J. Doyle, notes that the only complaint Petitioners were able to establish (of many) was that the mining operation could theoretically increase noise levels. But neither organization could show a single member who lived closer than 2,000 feet to Greenidge’s plant—so the claim was thrown out.

To reiterate, the only claim they could establish was noise levels.

That’s not all. A review board commissioned an acoustic study of simulated noise levels—not once, but twice—and both times found that the noise levels were well within the local zoning ordinance.

This is from the President of Greenidge, Dale Irwin:

“Every press release they issue, every attack they levy against the people who work at Greenidge, just like every lawsuit they file, is easily pulled apart once the facts are reviewed, and the court system did so today. It’s been an unbroken record of failure in attempting to use the courts to harm a lawful business and they have wasted taxpayers' money again, as the Judge eviscerated each of their baseless arguments.”

Also notable, the full text of the decision by Judge Doyle states that Greenidge’s bitcoin mining operations would not increase the plant’s energy production but would use energy that is already being generated by the plant. Thus there would be no increase in environmental impact from Greenidge’s bitcoin mining operations.

Surplus energy generated in excess of grid demand is often unable to be sold—thus making bitcoin mining a ‘buyer of last resort’ for energy producers.

So if bitcoin mining can use any source of energy production to power its operations—what about using clean, renewable energy? Blockstream and Block, two companies in the crypto space, will partner on an initiative to operate a bitcoin mining facility in conjunction with an off-grid solar array, storing the power generated in Tesla battery packs.

The project will be run entirely on solar power and will include a public-facing dashboard of the power produced by the facility.

If there is anything to take away from the current state of bitcoin mining—it is that the technology is new. It will still have to win the public trust to be fully adopted by most energy producers. Even amid the rampant misunderstanding and swarms of malicious actors attempting to tar and feather the technology—bitcoin mining is still being adopted and proving itself in real-world applications. Some environmentalists also misunderstand the technology and its future applications and thus misplace their anger in the present.

It will be a long road forward as bitcoin mining becomes the effective standard for renewable energy projects. But the facts are clear—it is proving to be a strong incentive to increase the production of clean, renewable energy. If only people would listen.

Read more: