A Brief Intro to Nexus Mutual

An overview of the protocol, the steps required to get a quote, and how to purchase coverage

As decentralized finance (DeFi) grows, more and more value is locked in the smart contracts of various protocols. These large pools of capital are vulnerable to smart contract hacks and exploits. Nexus Mutual, founded in 2017, emerged as a way for people to cover themselves against loss.

Nexus Mutual offers decentralized insurance. Unlike the traditional insurance model, Nexus is owned entirely by its members. Everyone’s incentives are aligned with a community ownership model. The protocol issues a token (NXM), which provides an economic incentive for members to participate in risk assessment, claims assessment, and governance.

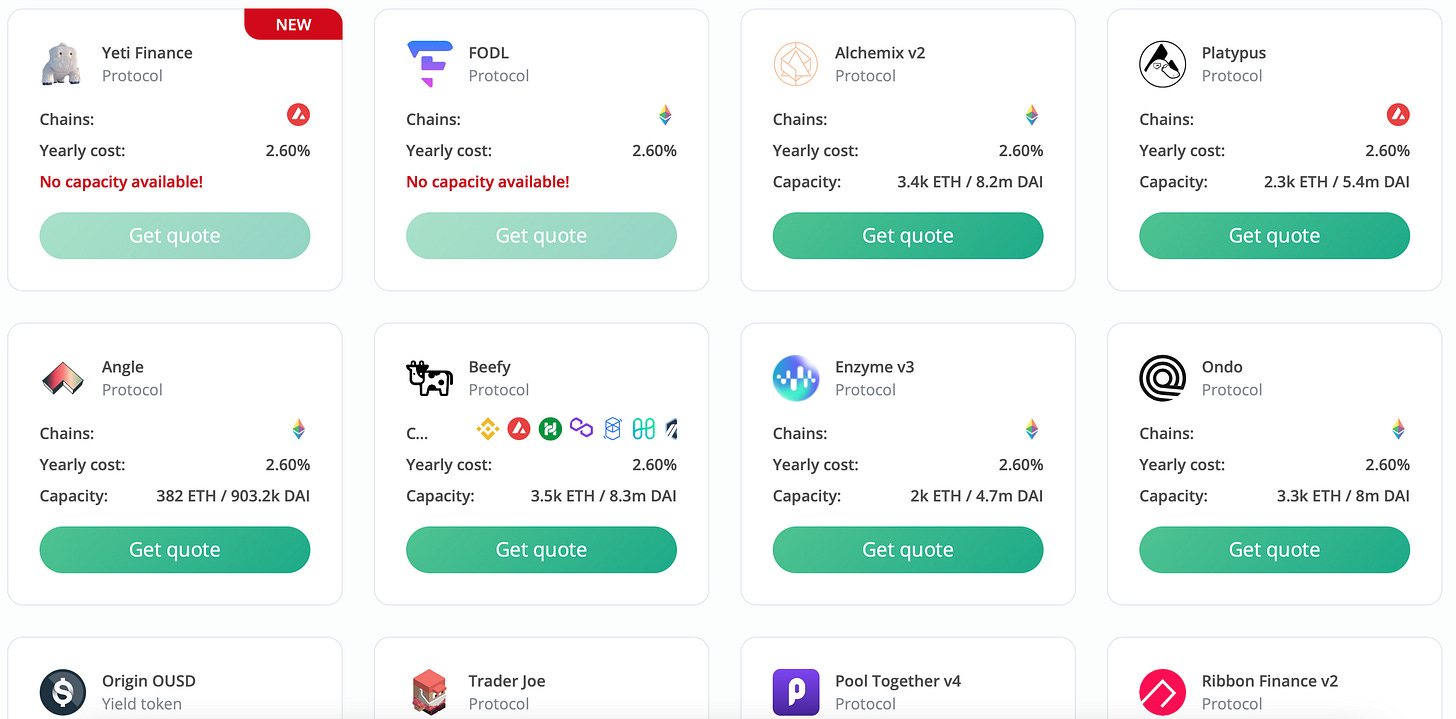

Coverage options are segmented into three use cases.

Yield token. If you hold a yield-bearing token, the token will often depend on other protocols to generate the yield. If there is a failure in any of those dependent protocols, you would be able to claim any losses greater than 10% via Nexus.

Individual protocols. You can also protect yourself against exploits and losses on any individual protocol where you have funds committed.

For individual protocols, Nexus covers losses due to exploits in the protocol’s smart contract or related code, flaws in the economic design of the protocol, vulnerabilities in governance set-up, or problems with the protocol’s oracles.

Custodians. This coverage protects against losses or frozen assets on third-party custodial platforms, such as centralized exchanges or custodial wallets.

Nexus Mutual’s Balance Sheet

Looking at the balance sheet, we can see the Total Value Locked (TVL) of $445,572,547.

TVL typically refers to the total amount of assets staked in a protocol. In the case of Nexus, TVL reflects the total assets in Nexus pools—which you can see below.

Take the Alchemix v2 pool as an example: The pool has a total coverage capacity of 3,400 ETH, equivalent to $8,005,538 at $2,354.57/ETH.

Getting a Quote

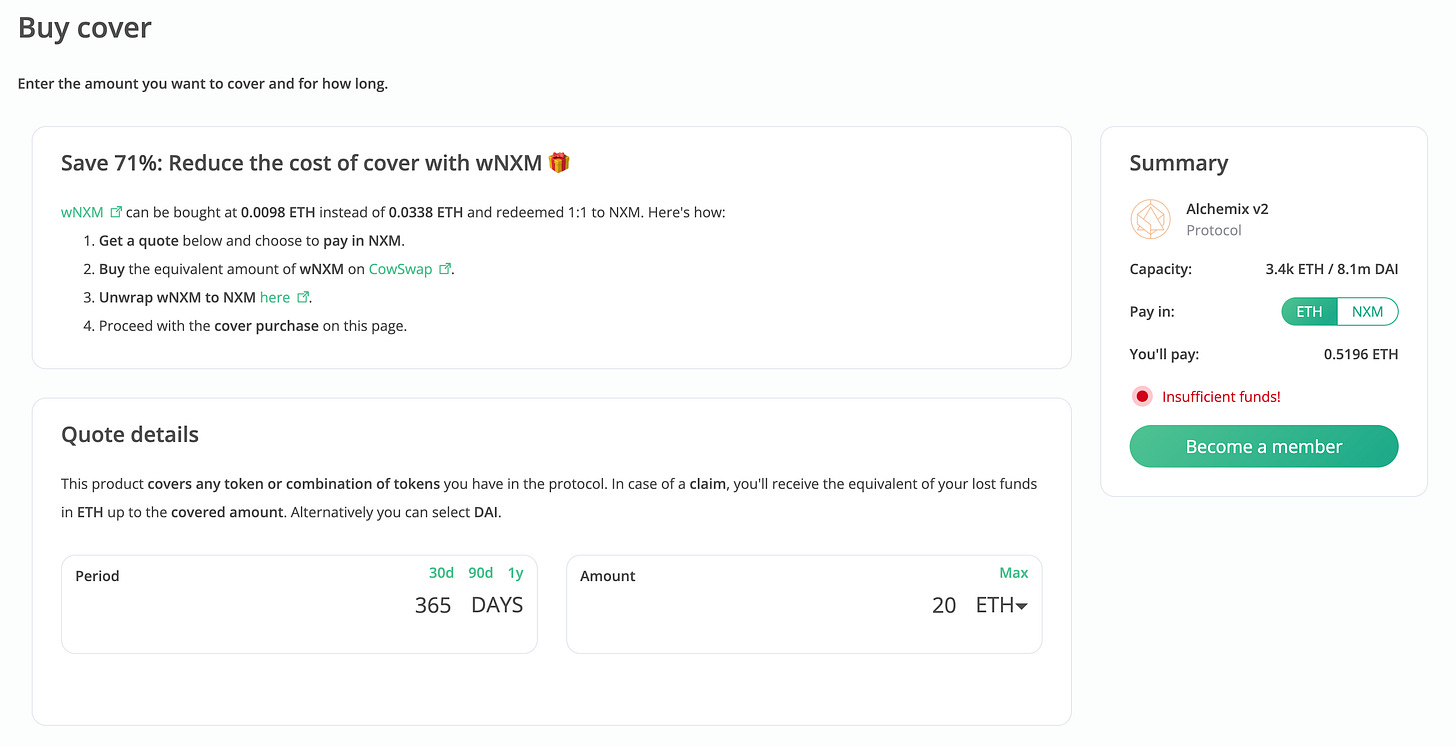

The user selects the protocol where they would like coverage to get a quote. Below, we can see inputs for Period and Amount, reflecting the period the user would like coverage for and the amount of coverage desired.

Next, the user would connect their wallet (mine isn’t connected, hence the ‘insufficient funds’ warning), input their coverage duration and the amount of coverage they would like, and complete the transaction. Note the fee of 0.5196 ETH for 20 ETH of coverage, representing an annualized fee rate of 2.598%.

Users can purchase coverage in ETH, DAI, or NXM. It is interesting to note that even with purchases in ETH or DAI, the smart contract will automatically exchange the ETH/DAI for NXM before purchasing coverage with the converted NXM.

Once the transaction is complete, Nexus Mutual covers the user, who can submit a claim if they reach the coverage threshold.

That’s a brief look at decentralized insurance with Nexus Mutual. There is more to cover here, including filing a claim, voting on claims, and protocol governance, all incentivized with NXM.

We’ll cover these additional aspects of the protocol in a future issue.